open end credit and closed end credit

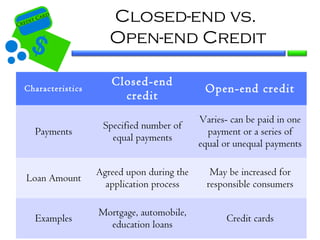

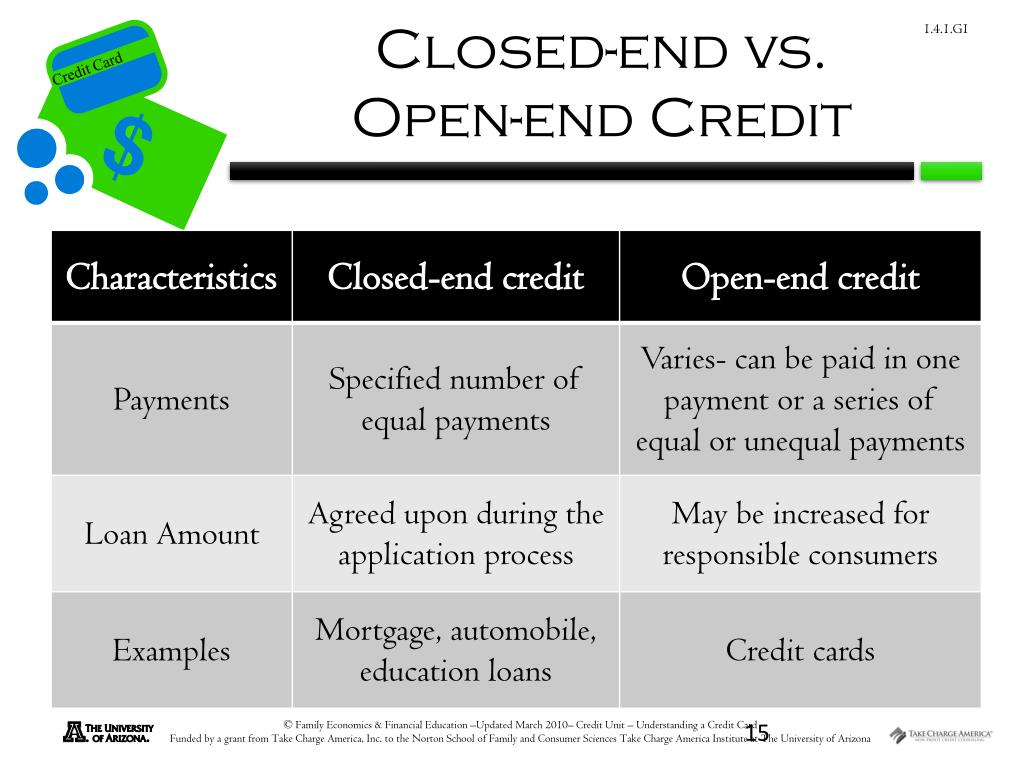

Consumer credit falls into two broad categories. Closed-end credit is a one-time installment loan you usually take out for a specific purpose.

Section 13 2 Consumer Credit Ppt Download

Closed-end credit allows you to borrow a specific amount of money for a finite term.

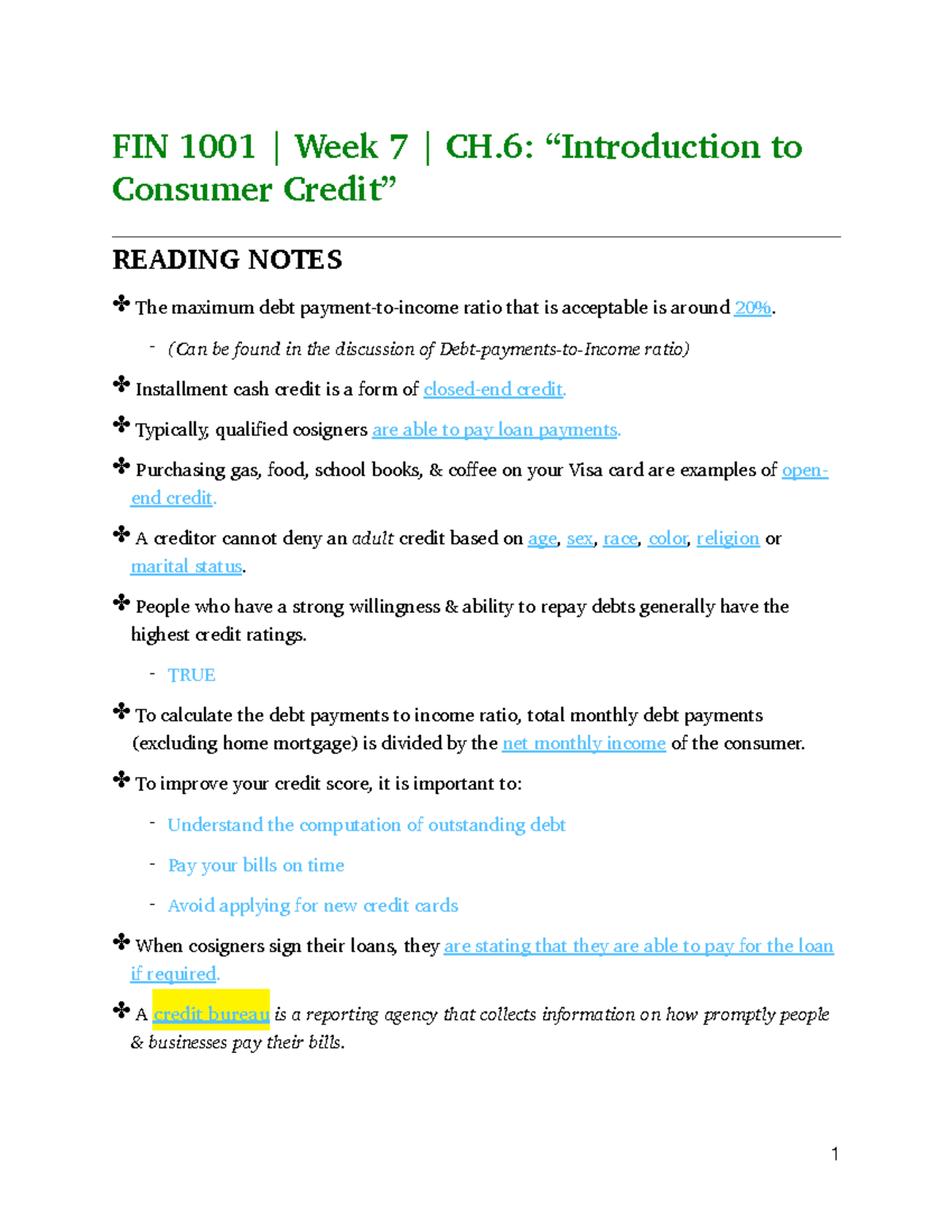

. Open-end credit agreements are also sometimes referred to as revolving credit accounts. If the terms of a credit card account under an open end consumer credit plan require the payment of any fees other than any late fee over-the-limit fee or fee for a payment. Open-end credit is an amount of credit that can be borrowed repeatedly as long as consistent.

The credit is obtained for a particular purpose and the borrower is required to pay the entire. Closed-end credit is used for a specific purpose for a specific. Abrdn Income Credit Strategies Fund NYSEACP and abrdn Global Dynamic Dividend Fund NYSEAGD each an Acquiring Fund announced that they each held a special.

A closed-end line of credit must be repaid at a predetermined point while an open-end line of credit. An open-end credit solves this difficulty by making credit available for usage as and when needed rather than expecting the borrower to complete repayments by a fixed date. At the end of a set period the individual or business must pay the entirety of the loan including any interest payments or maintenance fees.

Common types of closed-end credit instruments include mortgages an See more. Youll pay less interest overall by taking advantage. Open-end credit is an amount of credit that can be borrowed repeatedly as long as.

Closed-end credit is a form of credit that must be paid off by a specific date. Both forms of debt have their advantages and drawbacks. Lines of credit and closed-end loans differ primarily in.

Closed-end credit and open-end credit. Lines of credit are different than closed-end loans as we explained previously. In a closed-end credit the amount borrowed is provided to the borrower upfront.

5 Credit and Debt Management Types of Credit. Closed-end credit is a form of credit that must be paid off by a specific date. Closed-end installments and open-end revolving Closed-end credit.

Open-end loans like credit cards are different from closed-end loans like auto loans in. With closed-end credit you borrow money once and repay the loan. Open End Credit vs.

Closed-end credit usually has a lower interest rate than open-end credit which makes it better for longer-term borrowing. Closed-end instalment credit and open-end credit Closed-end instalment credit- the repayment terms are well defined. Popularity Open-end funds are significantly more common than closed-end funds.

The difference between these two types of credit is mainly in the terms of the debt. Specifically consumer credit typically comes in two categories. Closed-end creditincludes debt instruments that are acquired for a particular purpose and a set amount of time.

Open-end credit is a revolving credit product while closed-end credit is a nonrevolving lending product. Closed-end credit is a type of loan where the borrower receives a large lump sum upfront and agrees to pay back the full balance over a specific period of time like a mortgage or auto loan. Open-end credit also is referred to as a line of credit or a revolving line of credit.

As mentioned above a 48-month personal loan of 5000 featuring a 12 annual percentage rate of interest is a closed-end credit example. The choice of which type of credit to use will ultimately come down to why you need to borrow. Closed-end funds had just 309 billion in assets at the end of 2021 according to ICI.

There are two basic kinds of lines of credit. Thats the core difference between these distinct forms of credit.

5 Perks Of Home Equity Loans Midflorida Credit Union

What Is Open End Credit Experian

Types And Sources Of Credit Money Management Ii What We Re Doing Today Closed End Vs Open End Credit Loans Different Sources For Different Uses Credit Ppt Download

Credit 8 01 Evaluate Various Sources Of Credit Available To The Government Business And Consumers T G3 Ppt Download

Understanding A Credit Card Ppt Download

Types And Sources Of Credit Money Management Ii What We Re Doing Today Closed End Vs Open End Credit Loans Different Sources For Different Uses Credit Ppt Download

Mlo Mentor Section 32 Coverage Tests Firsttuesday Journal

Open End Credit Examples Open End Credit This Is A Type Of Credit Loan Paid On Installments In Which The Total Amount Borrowed May Change Over Time Course Hero

Understanding A Credit Card Take Charge Of Your Finances Advanced Level Ppt Download

Consumer Credit Chapter 15 Section 1 Ppt Download

Line Of Credit What Is Line Of Credit People Who Don T Vote Have No Line Of Credit With People Who Are Elected And Thus Pose No Threat To Those Who Act

Ppt Personal Finance Powerpoint Presentation Free Download Id 6166435

Definition Closed End Credit Is Defined As Credit That Must Be Repaid In Advisoryhq

Fin 1001 Week 7 Ch 6 Notes Fin 101 Csusb Studocu

Chapter Open Ended Credit An Agreement To Lend The Borrower An Amount Up To A Stated Limit And To Allow Borrowing Up To That Limit Again Whenever Ppt Download

Solved 问题41 25 Mary A Recent Western Washington University Chegg Com

What You Need To Know About Lines Of Credit Extra Blog

Open End Credit Examples Open End Credit This Is A Type Of Credit Loan Paid On Installments In Which The Total Amount Borrowed May Change Over Time Course Hero

Solved 1 What Is The Difference Between Loan Volume And Chegg Com